Barclays: China Stimulus - Evaluating the impact (10/04/2024)

We estimate the recent monetary, equity market and housing policies collectively could lift GDP growth by 0.2-0.3pp, reflecting eased corporate and household debt burdens being partly offset by lower returns on savings, modest wealth effects from the equity rally, and some recovery in housing market sentiment.

Announced and expected China stimulus triggered a dramatic equity rally in the past two weeks, with roaring Chinese stocks in Hong Kong posting their best two-week gains since at least 2005. The coordinated policy efforts following the PBoC's 24 September "big gift package", and signals that more fiscal support is on the way with President Xi urging to achieve the growth target, have alleviated market concerns about the government's willingness and ability to act. Investors are increasingly focusing on the details and impact of the supportive measures.

In China stimulus: Incremental vs bazooka (27 September), we discussed the growth implication of: 1) the PBoC measures; 2) a likely CNY2trn fiscal support (mild stimulus); and 3) a potential CNY10trn fiscal package ('bazooka' stimulus). In this report, we take stock of the policy measures - What's new? What's old? What's next? - with an emphasis on analytical details, in response to investors' inquires.

To help the comparison hence the evaluation, in Figure 1, we summarise major easing measures, in the areas of monetary, fiscal, and property policy, that were announced before and after the late September PBoC stimulus package, as well as the measures we expect to come in two scenarios. In the Appendix, we detail the policies announced YTD and their impact so far.

Evaluating the impact of the latest policy stimulus

Symmetric interest rate cut and mortgage rates cut

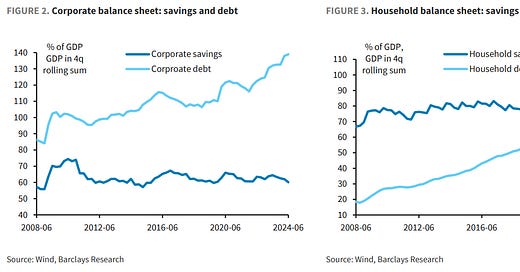

To protect banks' NIM, PBoC governor Pan said lending and deposit rates will be cut symmetrically by 20-25bp. We estimate a cut of such magnitude would benefit corporates and free some capacity for new investment, while given the high savings of the Chinese households, the benefits from the 50bp mortgage rate cuts and loss from deposit rates cut are almost cancelled out.

Specifically, for corporates, we estimate the cut in lending rates could reduce corporate interest payments by ~CNY450bn (based on banks' claims on corporates reported by the PBoC, CNY179trn as of August, and a 25bp cut), while a cut in deposit rates would also lower corporate savings returns by ~CNY200bn (based on banks' source of funds from corporates, CNY76trn), resulting in a net benefit of ~CNY250bn. Assuming corporates tap half of savings to increase capex, we estimate it could boost GDP growth via investment by ~0.1pp.

For households, we estimate a cut in deposit rates could reduce household saving returns by CNY160bn per year (based on banks source of fund from households, CNY147trn as of August plus outstanding wealth management product of CNY28.5trn as of June), almost equivalent to CNY150bn savings from the 50bp cuts in existing mortgages interest rates. So the net benefits to households are almost zero.

Wealth effect and recovery in sentiment

China's government has been ramping up efforts to stabilise the stock market; positive wealth effects have been a consideration for this priority given there are 220mn retail investors in China, which account for ~30% of the labour force and 16% of the total population. Since the PBoC's stimulus package, onshore equity market posted a 20-plus % rally, from the trough in mid-September.

Using cross-country panel data, an ECB working paper shows a 10% increase in equity prices boosts consumption by 0.1% in China1 . This implies the recent rally in the equity market, if sustained, will boost China’s consumption growth by 0.2pp, or boosting GDP growth by 0.1pp.

We think the smaller wealth effect in China vs other Asia economies (0.3% in HK, 0.4% in Korea, and 0.5% in Singapore from a 10% increase in equity prices) reflects underperformance of the Chinese equity market in the past decade, less developed financial market, as well as Chinese household balance sheets featuring high savings ratios to smooth consumption and surging debt burdens. Household income growth, on the other hand, has been statistically proven to be a more dominant driver for Chinese private consumption (see China Consumption: Marking down expectations, 29 Jul 2022).

Moreover, we think the relaxation in home purchase restrictions in tier 1 cities (announced on 29-30 Sep), along with last week's cut in downpayment ratios, could help stabilise market sentiment and home prices in top-tier cities, and contribute to consumption.

Housing policy: more for T1 cites, but hard to rekindle national market

Given the importance of the property sector to the overall economic recovery, we think it's important to gauge the impact from the relaxation of home-purchase restrictions in tier 1 cities and the cut in dowpayment ratios. We think the recent housing policy moves will lift full-year national sales forecast to -15% in 2024 (YTD: -18% y/y) and -8% in 2025.

This is based on a bottom-up analysis as in China: Property sales - weak for longer, 8 June 2023, where we examined property sales in three groups of cities, tier-1 cities (4), tier-2 cities (31) and the rest, based on NBS's classification of city tiers. Using city-level data on new residential sales in 80 cities from CRIC (real-estate information provider China Real Estate Information Corporation), we estimate that property sales in tier 1, tier 2 and tier 3-4 (lower tier cities) accounted for 3%, 19% and 78% in 2023.

With the Politburo explicitly calling to “stop the decline” in home prices and the relaxation in home-purchase restrictions in tier 1 cities, we think home prices in tier 1 cities could stabilise or even see some mild increase in 2025, which in turn could spill over to tier 2 cities. However, we think it will be difficult to stabilise home prices in lower-tier cities given high inventory and population outflows.

In view of a stabilization in home prices, we expect property sales to see a 10pp increase on average in tier 1-2 cities. Given tier 1-2 cities collectively account for ~20% of total sales, we estimate this will lift property sales forecast by 2pp to -8% in 2025 and -15% in 2024. In contrast, we think the impact on property investment and new starts are limited given the politburo said the government will strictly control the increase in housing construction, and optimize existing commercial properties.

All eyes on fiscal

The September Politburo suggests a consensus has likely been reached among top leadership that fiscal stimulus and central government leverage are necessary to arrest the downturn. This is an important shift in a market that was looking for more than just the bare minimum.

An effective package to arrest the downturn

We think the key consideration of economic impact is not what China announced last week, but what may lie ahead. On this front, our view is that the intensified PBoC easing and (former) governor's comments on (de)inflation show that the authorities are taking deflation risks seriously. A consensus has likely been reached in Beijing that fiscal stimulus and central government leverage are necessary to arrest the downturn, with damaged household, corporate and local-government balance sheets curtailing their capacity and willingness to borrow, spend and invest.

We think an effective package to reverse the deflationary expectation and downward economic trend should consist of the following three components:

a stabilisation of the house price/property sector (China Property: Prolonged pain, 7 September 2023, and see the box below on Housing inventory destocking vs guaranteeing housing completion);

a sustained improvement in the labour market/employment and income (China: Worsening employment; slowing momentum, 8 July 2024);

restored corporate confidence and improved business environment, correcting the procyclical fiscal tightening (China: Zoom in on fiscal data, 2 September 2024).

CNY2trn vs CNY10trn fiscal package

In the past week, a number of leading government-affiliated economist have proposed ~10trn fiscal stimulus, including Liu Shijin, Yu Yongding, and Jia Kang.

We think ~ CNY2trn fiscal stimulus is likely to be rolled out in the coming weeks, mindful of an NPC standing committee meeting (for budget approval, etc.), in late October or early November, around the time of the 5 November US election. Our estimate, based on a certain composition, suggest 2trn fiscal support could lift GDP growth by ~0.4pp, led by consumption (0.3pp), and investment (0.1pp).

We also explore an upside surprise scenario of a bazooka stimulus (a CNY10trn over two years), whic we estimate could boost GDP growth 1pp, led by consumption (0.7pp) and investment (0.3pp).

1) A mild stimulus scenario, which was reported by Reuters2 and which we see as reasonably likely to materialise, is that China's MoF plans to issue CNY1trn to stimulate consumption and another CNY1trn to help local governments tackle debt. The proceeds of the first will be used to increase subsidies for the trade-in and renewal of consumer goods, support large-scale business equipment upgrade, and fund a monthly allowance of CNY800 per child to all households with two or more children. While details are not unveiled, we think a CNY1trn fiscal transfer to LG could support basic public services and provide capacity for infrastructure spending, which would benefit both consumption and investment. We estimate such a mild fiscal stimulus could boost GDP growth 0.4pp in the next 12 months, mainly via consumption (0.3pp) followed by investment (0.1pp).

2) A bazooka stimulus scenario, which is a much larger package, is perhaps CNY10trn fiscal package over two years. Although this would have a major effect on GDP (1pp boost to GDP growth), it remains nothing more than speculation at this stage (fuelled by, among other things, a call from Liu Shijin, former deputy head of DRC). Specifically, to examine its growth impact, we take cues from the Politburo meeting statement, and think the package could involve a CNY3-5trn Housing Stabilisation Fund to mop up housing inventory (a scale needed to stabilise prices, by our estimate); a CNY2-4trn fiscal transfer over two years to LGs to ease the debt burden, support basic public services, and provide capacity for infrastructure spending; CNY2trn funding over two years to support consumption ; and CNY1trn funding to inject capital into big state banks. Reflecting this, we estimate the bazooka stimulus could boost GDP growth 1pp, led by consumption (0.7pp) and investment (0.3pp). This is consistent with the IMF's estimate based on a fiscal multiplier of 0.33 .

Housing inventory destocking vs guaranteeing housing completion

In this section, we elaborate our thoughts on why we think a potential CNY3-5trn Housing Stabilisation Fund to mop up housing inventory is necessary.

Since the housing bubble burst in 2021, the PBoC has cumulatively introduced CNY550bn (CNY350bn in special loans to policy banks + CNY200bn in relending facility to banks; both announced in 2022, and accounted for ~5% of annual property sales) in loans to guarantee housing completion, while the central bank in May 2024 only introduced CNY300bn (~3% of annual sales) in relending facility to destock inventory.

While guaranteeing housing completion is critical for social stability, we think clearing the housing inventory is more important in terms of economic impact given unsold completed units outnumber sold ones under construction by 10-to-1. According to the E-house report, the ratio of sold but uncompleted property was only ~4% in 2023, with total volume sitting at 230mn sqm (~23% of annual sales). In contrast, the Ehouse estimated that the new property inventory to sales ratio was ~27 months (~2.3 times of annual sales) as of July 2024, based on the 100-city data.

Consistent with our view, our property analyst estimated that a support package worth as much as CNY4trn is needed to clear the ~400mn sqm GFA (gross floor area) of completed but unsold residential property units. If including unsold inventory available for presales (but not completed), then around CNY8trn may be needed to to normalise inventory levels (see China stimulus: This could be big, 27 September).