Barclays: Apple - Downgrading to UW; Time for a Breather

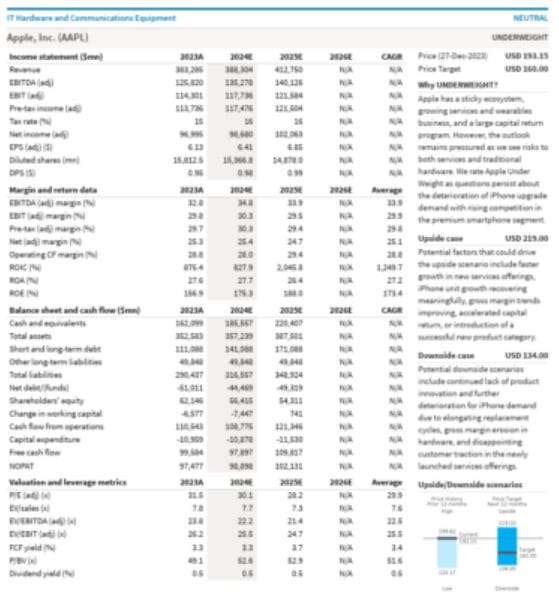

We are reducing our rating from “Equal Weight” to “Under Weight”. IP15 has been disappointing and we believe IP16 should be the same. Other hardware categories should remain weak and we don't see Services growing more than 10%. We expect a reversal after a year in which most quarters were lost and stocks outperformed.

We are slightly reducing our estimates for AAPL after another round of revisions. We're still seeing weakness in iPhone volumes and mix, as well as a lack of recovery in Macs, iPads and wearables. The biggest takeaway from the latest reviews is that IP15 data in China is worse than expected, along with weakness in developed markets.

There is some strength in emerging markets, but not enough to offset the situation. While we expect the December quarter to be largely in line with expectations, we further reduce our estimates for the March quarter below consensus. We believe the March quarter should be close to seasonal, while Wall Street is still modeling 10 points above seasonal. We lowered our revenue estimates for iPhones and wearables in the March quarter, reducing revenue and EPS by low single-digit percentages compared to our previous estimates. For Services, although the App Store is growing at 10% in the December quarter compared to an easy comparison period, we expect it to slow to low single-digit percentage growth by the third quarter of 2024. Our estimate for the March quarter is now a low single digit percentage below Wall Street expectations in terms of revenue and EPS, where we forecast a year-over-year decline in revenue after a flat December quarter and four previous quarters of decline.

We are slightly reducing our price target from $161 to $160, still using a P/E multiple of 25x our FY24 EPS estimate. We lowered our rating from “Equal Weight” to “Underweight” as we believe the continued period of weak results, coupled with multiple expansion, is not sustainable. We also believe that 2024 will bring to light more risks for the Services.

We are lowering our estimates after another round of reviews that showed weakness across all hardware categories. We are slightly reducing our price target from $161 to $160, still using a P/E multiple of 25x our FY24 EPS estimate. We are downgrading AAPL from “Equal Weight” to “Underweight” as we believe the sustained period of weak results, with an increased focus on Services risk, will begin to impact the multiple. Our more conservative view is based on several factors.

We expect weakness in iPhones to continue through the launch of the iPhone 16. Our research remains negative on volumes and mix for the iPhone 15, and we don't see any features or improvements that would make the iPhone 16 more attractive.

We believe that Mac and iPad need to return even further to pre-COVID-19 levels. These two products together were showing virtually no growth before the pandemic, but are still performing 20-30% above those levels even though the rest of the industry has corrected.

We see a slowdown in Services growth, with an increase in regulatory risk. We model ~10% and ~8% growth in Services in FY24 and FY25, well below the previous estimate of ~20% growth. In 2024, we should get an initial determination on Google's TAC, and some investigations into the app stores could intensify.

Valuation is stretched, especially after several weak quarters. AAPL stock performed well in 2023, but EPS declined throughout the year, so it was all due to the P/E multiple expansion. Since we believe the numbers will not improve, we anticipate pressure on the P/E multiple in the new year.

In the long term, there are diminishing returns in the ecosystem. AAPL is still a very strong ecosystem, having transitioned from Mac-driven to iPhone-driven over the last decade. We believe there is less ecosystem appeal in new products/services, which will hinder growth in the coming years.

Weakness in iPhones

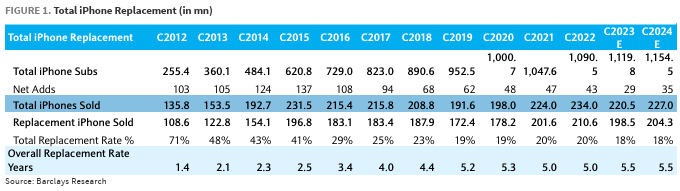

At approximately 50% of total revenue, the iPhone remains the most important product category for AAPL. Quarter-on-quarter growth has been subseasonal in five of the last six quarters, with negative revisions to the numbers, and we expect this trend to continue.

Our iPhone research has been weak over the past few months. Recent reviews point to production cuts, weak sales, and a shift in the mix toward base models instead of more expensive Pro versions.

Our initial opinion on the iPhone 16 is that there will be very little difference in features/functions compared to the iPhone 15. Without compelling changes, we see less room for device upgrades, especially in a challenging macroeconomic environment.

After a two-year period with a better-than-trend refresh rate, we see 2023 and 2024 as years of mean reversion. In general, a weaker macroeconomic context will lead to a lengthening of retention cycles.

Upward sensitivity with shorter retention times: If we assume retention times in calendar year 2024 return to pre-COVID-19 levels of 5.2 years, it would imply sales of 240 million iPhone units in the year calendar 2024, compared to our current estimate of 227 million. 240 million would translate to EPS of $6.70 for calendar year 2024, which represents a 2% increase compared to our current estimate of $6.54 for calendar year 2024.

Mac and iPad

In the five years before the COVID-19 pandemic, the combined Mac and iPad remained in a revenue range of around $45 billion, declining to a high double-digit percentage of AAPL's total revenue. Revenue rose to nearly $70 billion in fiscal 2022 and was still 28% above pre-pandemic levels in fiscal 2023. Although both products posted declines in fiscal 2023, we anticipate further declines as these categories align more in line with the industry.

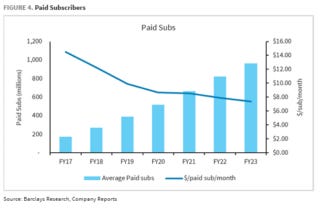

Services

Services accounted for 22% of revenue in fiscal 2023 and contributed 36% of gross profit. This business is probably responsible for the change in AAPL's valuation in recent years, as it is a great way to monetize the ecosystem, especially with recurring revenue. In fiscal 2023, this business grew below 10% for the first time in its history. Please see our detailed report, “Apple Services Overview,” where we discuss growth in the high-single-digit/low-single-digit range as the new norm for this business. Some of the highlights include:

App Store growth has slowed due to macroeconomic factors, but also pressures in the gaming market. Many countries are examining AAPL's App Store practices, including concerns about the 30% fee, third-party payments, and alternative app stores. All of these factors could put pressure on revenue over time.

We believe the best business in Services is AAPL's own advertising, which is growing at high single-digit rates. AAPL is still expanding advertising across more of its apps, so growth here should be positive. Most of the advertising revenue (about $20 billion a year by our estimates and growing) comes from Google's TAC. We expect to hear a decision in the Google/DoJ case in mid-2024, where the judge will determine the legality of Google paying Apple to be the default search engine on the iPhone. Other regions (Europe and India) have ended this practice, but only on Android. This pure profit revenue stream represents the biggest risk to AAPL's business model.

Music and TV. We would have expected both businesses to have higher adoption rates (see Ecosystem section below). We estimate that Music+ and TV+ have 8% and 3% penetration of the iPhone user base, respectively. Profitability is limited on Music+ due to the high royalties paid to record labels and other industry participants. We estimate that TV+ is losing $6 billion a year due to lack of scale and high cost of content.

Others. AppleCare and iCloud are good services, but we see them as somewhat related to new device sales, which are lagging. Apple Pay is growing well, but the revenue base is likely too small to be meaningful. So far, we haven't seen any trailers for Arcade, News, or Fitness.

Ecosystem

AAPL has long been a company known for its strong ecosystem. What started with a Mac became an iPod and then a huge success with the iPhone. The hardware ecosystem is strong, and the App Store has been a great product over the years.

We think we're seeing less ecosystem pull as time goes on. Using our installed base of iPhones, we looked at some of the newer products and services and noted that the traction for most of the services added in the last five years has been disappointing. We think this might not bode well for other new products like the Vision Pro.

Assessment

AAPL's price-to-earnings (P/E) ratio has nearly doubled over the past five years and increased by 50% in 2023. Most attribute this increase to strong cash flows and growth in Services. We believe this high P/E multiple is not sustainable given the lack of growth we model. We expect significant limited innovation and continued weakness in demand/regulation, which should put pressure on the multiple in 2024 as there is little room for upward revisions to estimates. The relative valuation chart shows that AAPL currently has a 65% premium over the S&P 500, which is a high benchmark.

We are lowering our price target on AAPL to $160 (previously $161), based on a 25x P/E multiple on projected EPS of $6.41 for fiscal 2024. Our previous price target was based on a 25x P/E multiple on a previous projected EPS of $6.42 for fiscal 2024. We believe our target multiple of 25x remains appropriate given the weak macroeconomic situation and increasing challenges in the hardware and services categories.

We are also lowering our fiscal 2024 EPS guidance to $6.41 from $6.42. Our estimate is below the consensus EPS for fiscal 2024, which is $6.60.